How much is capital gains tax? See our Tax Calculator

CAPITAL GAINS TAX ON A HOUSE SOLD DURING A DIVORCE

During a divorce, when selling the marital home, you need to understand capital gains taxes.

The process of buying a new home is an exciting one for married couples. Unfortunately, when it comes time to sell a house, there may not be such happy circumstances. When a sale of the marital home involves potential capital gains taxes, understanding the available exclusion tests is crucial. In general, both the homeownership and the use tests must be met in order to qualify for the Section 121 exclusion.

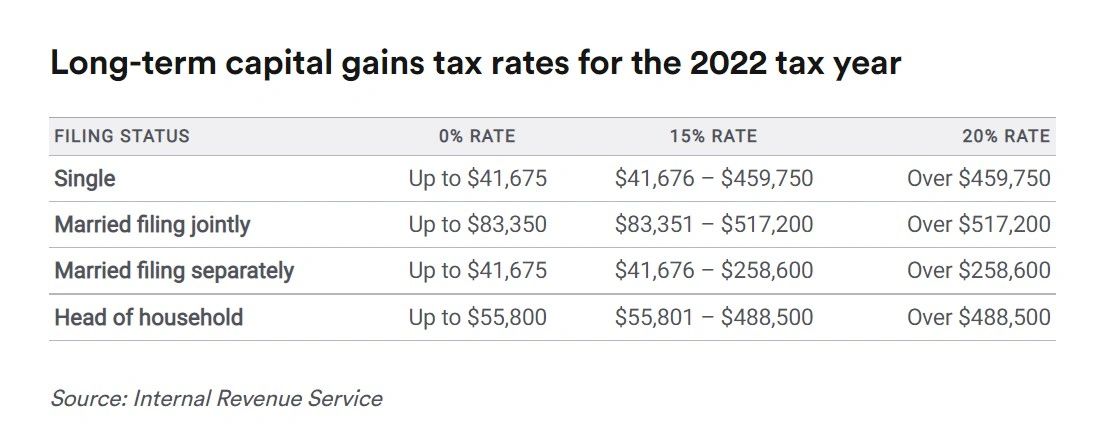

The current Capital Gains Exclusion on the sale of the primary residence currently allows for a 250,000 individual exclusion. Married couples are allowed a 500,000 marital exclusion. Read below for more details and Tax Rates below.

Capital Gains Tax When You Sell Your House at Divorce Capital Gains Tax

When You Sell Your House at Divorce

Buyout your Spouse

After a buyout, the selling spouse doesn't need to worry about capital gains tax because the sale was part of the divorce. But if you buy out your spouse, stay in the house, and later sell the house to a third party, capital gains tax will apply to that sale.

You may exclude the first 250,000 of gain as long as you've lived there for two years before selling or meet one of the IRS exceptions to that rule. We can help determine how to calculate buying someone out of a house and how to give equity to a spouse in a divorce?

Use our Capital Gain Tax Calculator to estimate your after-tax investment gains.

See more athttps://thegiffordgroup.net/capital-gains-calculator